In a world driven by financial intricacies, navigating the path to prosperity can be challenging for many. The ever-evolving landscape of the financial sector demands individuals to be well-versed in the essentials of fiscal management. This crash course serves as a comprehensive guide, offering insights and strategies to empower you on your journey to financial success.

Unraveling the Basics

1. Financial Literacy: The Foundation

Achieving financial success begins with a solid understanding of financial literacy. In this section, we delve into the importance of knowing the basics—budgeting, saving, and understanding the dynamics of credit. By mastering these fundamentals, you lay a robust foundation for your financial future.

2. Investment Strategies: Making Your Money Work for You

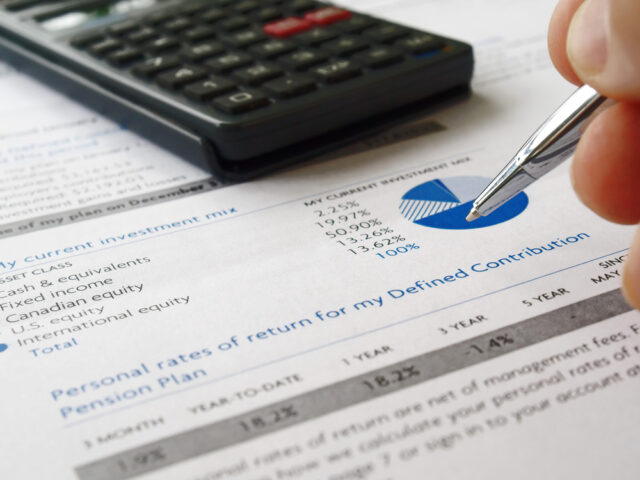

One of the key pillars of financial success is smart investing. We explore various investment strategies, from traditional options like stocks and bonds to contemporary choices such as cryptocurrency. Understanding risk tolerance and diversification is crucial in building a portfolio that stands the test of market fluctuations.

Mastering Advanced Concepts

3. Tax Planning: Maximizing Returns, Minimizing Liabilities

Taxes are an inevitable part of financial life, but with strategic planning, you can minimize their impact. This section provides insights into tax-efficient investing, deductions, and credits, ensuring you keep more of your hard-earned money.

4. Debt Management: A Prudent Approach

Effectively managing debt is often a decisive factor in financial success. We explore methods to tackle debt responsibly, discussing debt consolidation, repayment strategies, and ways to avoid falling into common debt traps.

Navigating Economic Challenges

5. Adapting to Economic Shifts

The global economy is dynamic, and being able to adapt is crucial. Learn how to navigate economic shifts, whether it be a recession or an economic boom. Insights into recession-proofing your finances and capitalizing on opportunities in prosperous times are discussed in this section.

6. Emergency Funds and Insurance: Safeguarding Your Finances

Life is unpredictable, and financial setbacks can occur. Discover the importance of emergency funds and insurance in mitigating unforeseen circumstances, providing a safety net for you and your loved ones.

Putting Knowledge into Action

7. Creating a Personalized Financial Plan

Armed with knowledge, the final step is creating a personalized financial plan. We provide a step-by-step guide to crafting a plan tailored to your goals, whether it’s buying a home, funding education, or retiring comfortably.

Conclusion: Your Journey to Financial Success Begins Now

Embarking on a journey to financial success requires commitment, education, and strategic planning. This crash course has equipped you with the essential tools to navigate the intricate landscape of personal finance. Remember, the key is to continually educate yourself, adapt to changes, and make informed financial decisions. Check out their company website to find additional tips and information about personal finance.